Company Description

HedgeServ is a top-ranked global, independent fund administrator providing a unique client-centric service and is the industry’s leader in technology. Headquartered in New York City and Dublin, HedgeServ currently services more than $350 billion of assets. HedgeServ provides a service solution for front office, risk, valuations, middle office, fund accounting and fund administration that is customized to the needs of the individual hedge fund, fund of hedge funds and private equity funds. HedgeServ is located in Cork, Dublin, London, Luxembourg, Krakow, Sofia, New York, Boston, Sydney and Grand Cayman.

Middle Office Team

The HedgeServ Middle Office department has close links with our Dublin, New York and Sydney office. Due to the explosive growth we have experienced in Krakow, we are now looking to develop our Middle Office presence locally. The successful candidate will have an opportunity to join our team at a very early stage and play a key role in this growth and development. The new Middle Office team will work closely with the Dublin department and focus on our large and growing client base, projects and initiatives along with exposure to Hedge Fund Middle Office Space.

Job Description

The Middle Office Team in HedgeServ performs all trading desk support responsibilities required of large Multi-Strategy Hedge Funds. The Middle Office Graduate will work within the Middle Office team on such functions as electronic trade/deal capture; confirmation and settlements; issues resolution; cash and collateral management; technology development and valuations processing. The position will expose the successful candidate to all financial markets and products traded globally, including highly complex derivative instruments. You will develop invaluable inexperience around the extensive detail on how each product trades in the market. Additionally, you will get large exposure to live trading experience through our Portfolio Management System which is used by the Trading teams. The position boosts a very wide range of tasks across all facets of the trading cycle.

Key Responsibilities

- Review daily cash and position reconciliations; resolving breaks

- Ensure the accuracy of all trade bookings, end of day pricing, and client deliverables

- Effectively communicate with clients, assisting with all systems and trade related queries

- Work closely with the various Middle Office, Nav, IT, and Investor Service teams

- Assist the NAV teams in any queries regarding trades or pricing

Pre-requisite knowledge, skills and experience:

- Completed bachelor’s degree in business, accounting or finance

- Exposure to various key financial products, (i.e. Equities, Options, Futures, Fixed Income and various derivatives)

- Strong Excel skills and comprehension

- Ability to multi-task and succeed in a results oriented, high pressure environment with an understanding of the need for 100% accuracy

- Ability to communicate with people in a positive and effective manner.

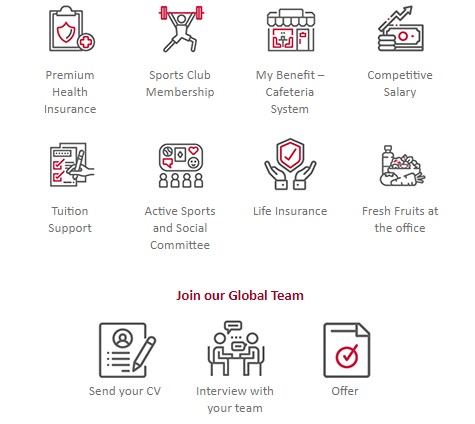

What do we offer?: